מורשת גדולי האומה

בזכותם קיים

beta

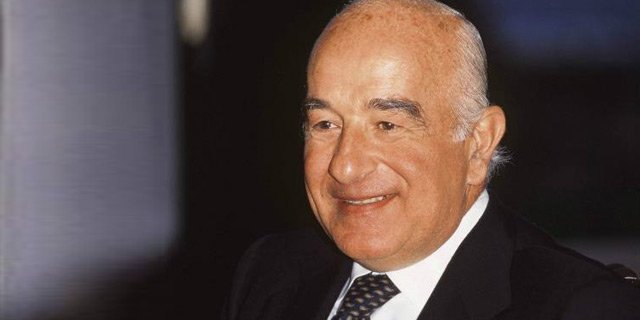

The Safra Family

The Safra family is a prominent Jewish banking and philanthropic dynasty with its origins in the city of Aleppo, Syria. Their financial success primarily began after they migrated to Beirut, Lebanon. Today, they are considered one of the wealthiest Jewish families globally, with Forbes estimating their combined holdings at around $200 billion.

Historical Roots

The name "Safra" in Arabic means "yellow" or "gold." Despite the discreet nature of their family history, preserved with vigilance until today, it is believed that the Safra family's early business endeavors involved trading gold, likely sourced from the camel caravans that traversed the region during the Ottoman Empire era.

In the mid-19th century, the Safra brothers established the "Banque des Frères Safra" in Beirut, focusing on financing the burgeoning trade between Europe and the Middle East. About a century ago, the family's business activities began to grow rapidly, expanding into modern banking. Following World War I, Jacob Safra, the patriarch of the modern Safra family, moved to Beirut and achieved great success in his business endeavors. Safra established the "Banque de Crédit National" while taking advantage of Beirut's transformation into a financial hub in the Middle East. His sons, Edmond and Moise, born in Lebanon, relocated to Milan, Italy, in 1949, where they established a company specializing in foreign currency trading, gold, and other precious metals.

In 1952, the family moved to Brazil and founded "Banco Safra" in 1957. Initially, their business activities in Brazil focused on managing assets for wealthy individuals and providing loans to businesses and private individuals in exchange for strong collateral, such as real estate. This strategy allowed them to navigate the political instability that characterized Brazil during that time, along with high inflation and an economically volatile environment. Safra began acquiring small banks, merging them into the family bank, and investing in real estate and textile companies. In 1998, they were granted a license to establish a cellular phone company in Brazil, in partnership with BellSouth from the United States. However, in 2003, they sold the company at a loss after substantial investments.

In 1956, Edmond Safra settled in Geneva, Switzerland, where he founded Trade Development Bank while cultivating personal relationships and providing personalized services to wealthy individuals worldwide. The bank's assets grew from an initial $1 million to $5 billion. In 1966, Edmond Safra also established the "Republic National Bank of New York." In the 1980s, the bank had 80 branches in New York and its surroundings. In 1983, Trade Development Bank was sold to American Express for over $550 million. As part of the sales agreement, Edmond Safra was appointed head of international activities at American Express. After the sale, a legal dispute arose between the two parties, resulting in a public apology from American Express for falsely accusing Safra of initiating a hostile takeover bid and an $8 million donation to charity.

In 1988, following the expiration of a non-competition agreement with American Express, Edmond Safra founded "Safra Republic Holdings S.A," a European financial conglomerate, with a billion-dollar capital base derived from the branches of "Republic National Bank of New York" in Europe. The group focused on private banking services for wealthy clients. In 1996, they acquired Mercury Bank in Switzerland. In May 1999, they sold "Republic Group," which included "Republic National Bank of New York" in the United States and "Republic Holdings" in Europe, to the multinational banking group HSBC for $10.3 billion in cash. The completion of the deal was delayed for several months and was eventually closed in November 1999, with a waiver of $450 million.

On December 3, 1999, Edmond Safra tragically died in a fire in his penthouse apartment in Monaco.

In the 2000s

In July 2006, Joseph Safra acquired his brother Moise's shares in their joint businesses.

In August 2014, Joseph Safra purchased Chiquita Brands International (originally the United Fruit Company), which controlled banana cultivation and trade in the Americas, for approximately $610 million.

In November 2014, Joseph Safra acquired "The Gherkin" (30 St Mary Axe) in London for £726 million.

In April 2016, Joseph Safra faced legal charges alleging his involvement in bribery schemes to reduce his company's tax liability.

In April 2018, Israel's Bank Hapoalim sold its private banking business in Switzerland to Safra Bank.

Activities in Israel

In 1986, the Safra family, particularly Jacques Nasser (Jacques Nasser was Edmond Safra's cousin, married to Evelyn Safra), acquired control of Israel's first international bank, the International Bank of Israel. Initially, the Safra brothers denied any involvement in the acquisition, primarily due to their desire not to jeopardize their business relationships in the Arab world. However, it later became public knowledge that the Safra family provided the funding for the purchase.

In 1990, formal control of the International Bank of Israel shifted from Nasser to the Safra brothers, Joseph and Moise. Despite officially registering Joseph and Moise as owners of P.Y.B.Y. Holdings, which held the International Bank of Israel, and with Edmond Safra being the effective owner of Republic Group, the latter, internationally known as "Safra Group of Banks," featured the family's emblem in its logo. When Edmond Safra attempted to purchase Bank Leumi in 1993, the Bank of Israel demanded that the family sell the International Bank of Israel. Ultimately, the Safra family withdrew from the transaction. Subsequently, a legal dispute erupted between Nasser's heirs and the Safra brothers over funds that supposedly were owed, leading to allegations that Edmond Safra controlled the International Bank of Israel in practice, despite its ownership being officially registered with P.Y.B.Y. Holdings. Nasser's heirs eventually lost the lawsuit.

In 1994, the Safra brothers acquired 35% of Cellcom's shares, and in 1998, they held 20% in the Carmelton Group, which won the bid to construct the Carmel Tunnels. The Safra family also engaged in negotiations for the acquisition of the Discount Bank and IDB Holdings.

In 2003, the Safra brothers sold the International Bank to Edouard Nakache, who had previously been the bank's CEO and was close to the family.

In 2005, the Safra brothers sold part of their shares in Cellcom to Nochi Dankner.

In conclusion, the Safra family's journey from Aleppo to becoming one of the wealthiest families in the world is a fascinating tale of financial acumen, international banking, and business ventures that have left a lasting impact on the global financial landscape.

The name "Safra" in Arabic means "yellow" or "gold." Despite the discreet nature of their family history, preserved with vigilance until today, it is believed that the Safra family's early business endeavors involved trading gold, likely sourced from the camel caravans that traversed the region during the Ottoman Empire era.

In the mid-19th century, the Safra brothers established the "Banque des Frères Safra" in Beirut, focusing on financing the burgeoning trade between Europe and the Middle East. About a century ago, the family's business activities began to grow rapidly, expanding into modern banking. Following World War I, Jacob Safra, the patriarch of the modern Safra family, moved to Beirut and achieved great success in his business endeavors. Safra established the "Banque de Crédit National" while taking advantage of Beirut's transformation into a financial hub in the Middle East. His sons, Edmond and Moise, born in Lebanon, relocated to Milan, Italy, in 1949, where they established a company specializing in foreign currency trading, gold, and other precious metals.

In 1952, the family moved to Brazil and founded "Banco Safra" in 1957. Initially, their business activities in Brazil focused on managing assets for wealthy individuals and providing loans to businesses and private individuals in exchange for strong collateral, such as real estate. This strategy allowed them to navigate the political instability that characterized Brazil during that time, along with high inflation and an economically volatile environment. Safra began acquiring small banks, merging them into the family bank, and investing in real estate and textile companies. In 1998, they were granted a license to establish a cellular phone company in Brazil, in partnership with BellSouth from the United States. However, in 2003, they sold the company at a loss after substantial investments.

In 1956, Edmond Safra settled in Geneva, Switzerland, where he founded Trade Development Bank while cultivating personal relationships and providing personalized services to wealthy individuals worldwide. The bank's assets grew from an initial $1 million to $5 billion. In 1966, Edmond Safra also established the "Republic National Bank of New York." In the 1980s, the bank had 80 branches in New York and its surroundings. In 1983, Trade Development Bank was sold to American Express for over $550 million. As part of the sales agreement, Edmond Safra was appointed head of international activities at American Express. After the sale, a legal dispute arose between the two parties, resulting in a public apology from American Express for falsely accusing Safra of initiating a hostile takeover bid and an $8 million donation to charity.

In 1988, following the expiration of a non-competition agreement with American Express, Edmond Safra founded "Safra Republic Holdings S.A," a European financial conglomerate, with a billion-dollar capital base derived from the branches of "Republic National Bank of New York" in Europe. The group focused on private banking services for wealthy clients. In 1996, they acquired Mercury Bank in Switzerland. In May 1999, they sold "Republic Group," which included "Republic National Bank of New York" in the United States and "Republic Holdings" in Europe, to the multinational banking group HSBC for $10.3 billion in cash. The completion of the deal was delayed for several months and was eventually closed in November 1999, with a waiver of $450 million.

On December 3, 1999, Edmond Safra tragically died in a fire in his penthouse apartment in Monaco.

In the 2000s

In July 2006, Joseph Safra acquired his brother Moise's shares in their joint businesses.

In August 2014, Joseph Safra purchased Chiquita Brands International (originally the United Fruit Company), which controlled banana cultivation and trade in the Americas, for approximately $610 million.

In November 2014, Joseph Safra acquired "The Gherkin" (30 St Mary Axe) in London for £726 million.

In April 2016, Joseph Safra faced legal charges alleging his involvement in bribery schemes to reduce his company's tax liability.

In April 2018, Israel's Bank Hapoalim sold its private banking business in Switzerland to Safra Bank.

Activities in Israel

In 1986, the Safra family, particularly Jacques Nasser (Jacques Nasser was Edmond Safra's cousin, married to Evelyn Safra), acquired control of Israel's first international bank, the International Bank of Israel. Initially, the Safra brothers denied any involvement in the acquisition, primarily due to their desire not to jeopardize their business relationships in the Arab world. However, it later became public knowledge that the Safra family provided the funding for the purchase.

In 1990, formal control of the International Bank of Israel shifted from Nasser to the Safra brothers, Joseph and Moise. Despite officially registering Joseph and Moise as owners of P.Y.B.Y. Holdings, which held the International Bank of Israel, and with Edmond Safra being the effective owner of Republic Group, the latter, internationally known as "Safra Group of Banks," featured the family's emblem in its logo. When Edmond Safra attempted to purchase Bank Leumi in 1993, the Bank of Israel demanded that the family sell the International Bank of Israel. Ultimately, the Safra family withdrew from the transaction. Subsequently, a legal dispute erupted between Nasser's heirs and the Safra brothers over funds that supposedly were owed, leading to allegations that Edmond Safra controlled the International Bank of Israel in practice, despite its ownership being officially registered with P.Y.B.Y. Holdings. Nasser's heirs eventually lost the lawsuit.

In 1994, the Safra brothers acquired 35% of Cellcom's shares, and in 1998, they held 20% in the Carmelton Group, which won the bid to construct the Carmel Tunnels. The Safra family also engaged in negotiations for the acquisition of the Discount Bank and IDB Holdings.

In 2003, the Safra brothers sold the International Bank to Edouard Nakache, who had previously been the bank's CEO and was close to the family.

In 2005, the Safra brothers sold part of their shares in Cellcom to Nochi Dankner.

In conclusion, the Safra family's journey from Aleppo to becoming one of the wealthiest families in the world is a fascinating tale of financial acumen, international banking, and business ventures that have left a lasting impact on the global financial landscape.

- משפחת ספרא – ויקיפדיהhe.wikipedia.org